According to the Texas Works Handbook:

A—231 Who Is Included

The following people must be certified as a Supplemental Nutrition Assistance Program (SNAP) household if they live together:

- Parents and children (natural, adopted or step) age 21 or younger. Parents and children living together when the parent or child is away from home for employment or educational purposes only, and returns home at least one day a month are considered. This includes college students who are eligible for SNAP, as explained in B-410, Students in Higher Education.

Notes:- Consider the individual’s age as 22 beginning the month they turn age 22.

———————

A—232.1 Nonmembers

The following are not included in a Supplemental Nutrition Assistance Program (SNAP)-certified group:

1. Roomers — Certify a roomer who pays for lodging but not food as a separate household unless the person meets one of the three categories of who is included in a SNAP household, if they live together.

2. Boarders — Boarders in noncommercial boarding houses cannot receive SNAP separate from the household they live with. Boarders who live in a commercial boarding house cannot participate in SNAP. Note: A foster parent or caretaker has the option to include or exclude a foster child or adult as a SNAP household member.

SNAP income limits & deductions:

- Standard deduction (see chart based on household size) – 1 person $193

- Standard medical expense — $170 (minus $35)

- Actual medical expense (minus $35)

- Homeless shelter standard — $159.73

- Maximum excess shelter (rent over $624) — $597

- Standard utility allowance — $367

- Basic utility allowance — $345

- Phone standard — $38

- 20 percent earned income deduction for households with earnings;

- dependent care;

- child support paid to or for non-household members;

- Plan for Achieving Self-Sufficiency (PASS)

C—122 How to Determine Monthly SNAP Allotments

To determine the monthly allotment for a household, use the whole monthly allotments by household size chart.

The monthly allotment is determined by:

- multiplying the household’s net monthly income by .30;

- rounding the cents to the next higher whole dollar amount; and

- subtracting the rounded sum from the maximum monthly allotment for the household size.

Disclaimer: this is my attempt to apply the formulas in the policies above.

In 2023, if an individual is a Roomer, 22+ years old, and received the full $914 SSI each month, this is the equation:

| Gross unearned income (SSI) $914 | Gross unearned income (SSI) $914 | Gross unearned income (SSI) $914 |

| Standard deduction – $193 | Standard deduction – $193 Phone Standard deduction – $38 | Standard deduction – $193 Standard Medical Expenses deduction – Cost minus $35 (For this example: medical cost is $60, so deduction will be $25) Phone Standard deduction – $38 |

| = Net Income $664 | = Net income $683 | = Net income $658 |

| multiply net income by .30; | multiply net income by .30; | multiply net monthly income by .30; |

| = $216.30 | = $204.90 | = $197.40 |

| rounding the cents to the next higher whole dollar | round the cents to the next higher whole dollar | rounding the cents to the next higher whole dollar |

| = $217 rounded sum | =$205 rounded sum | = $198 rounded sum |

| subtract the rounded sum from the maximum monthly allotment for the household size = $281 | subtract the rounded sum from maximum allotment for the household size = $281 | subtract the rounded sum from the maximum monthly allotment for the household size = $281 |

| $281 – $217 $64 monthly SNAP allotment | $281 – $205 $76 monthly SNAP allotment | $281 – $198 $83 monthly SNAP allotment |

If my conclusions are correct, the deductions you include on the application will make a big difference in your monthly SNAP allotment.

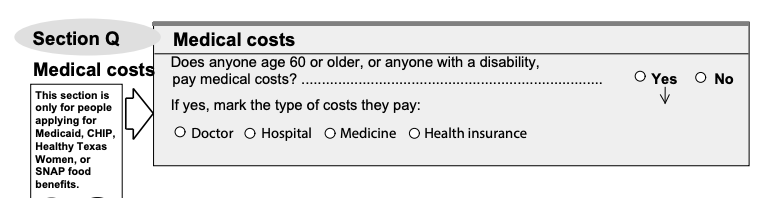

I think these 2 sections on Form to apply for Food Benefits (SNAP), Healthcare (Medicaid and CHIP), or cash help for families (TANF) (H1010) would be where you document items to get the Utility and Medical deductions:

You can apply at YourTexasBenefits.com or download and print an application.