Children (under 18 years old)

| Income level | Asset level | Program |

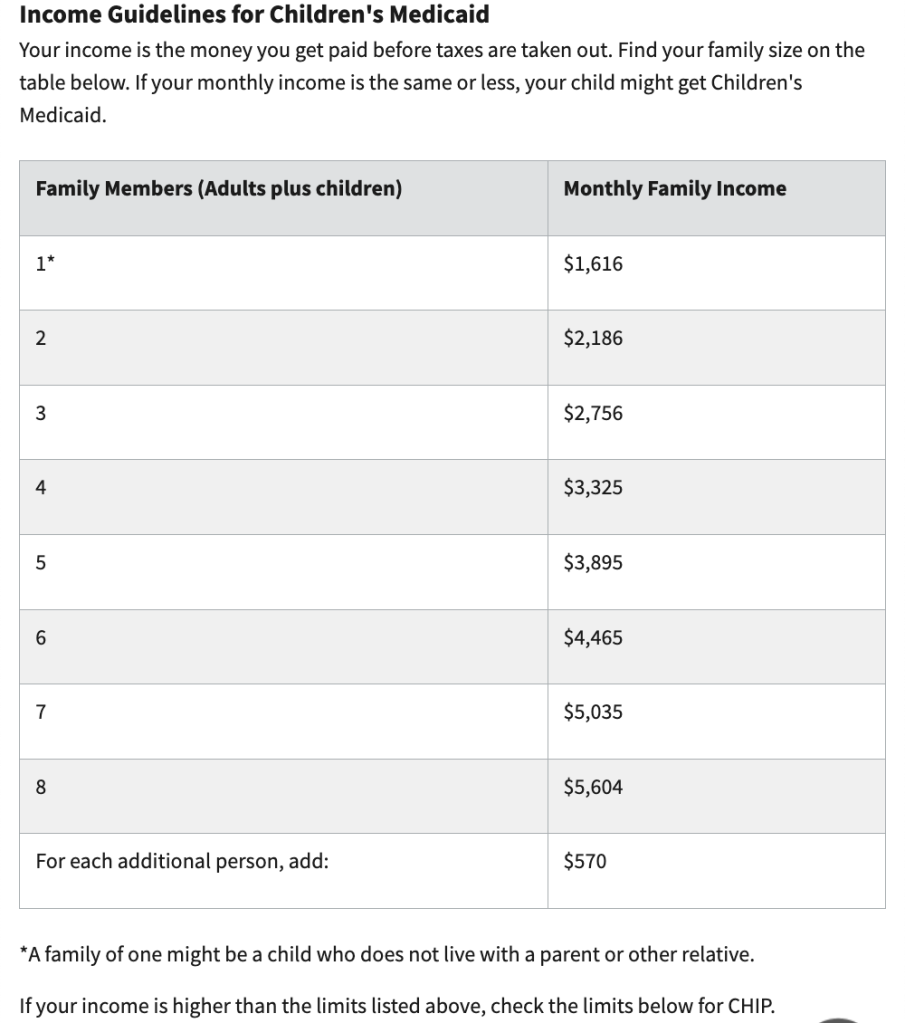

| Low family (income table) | No limit | Children’s Medicaid |

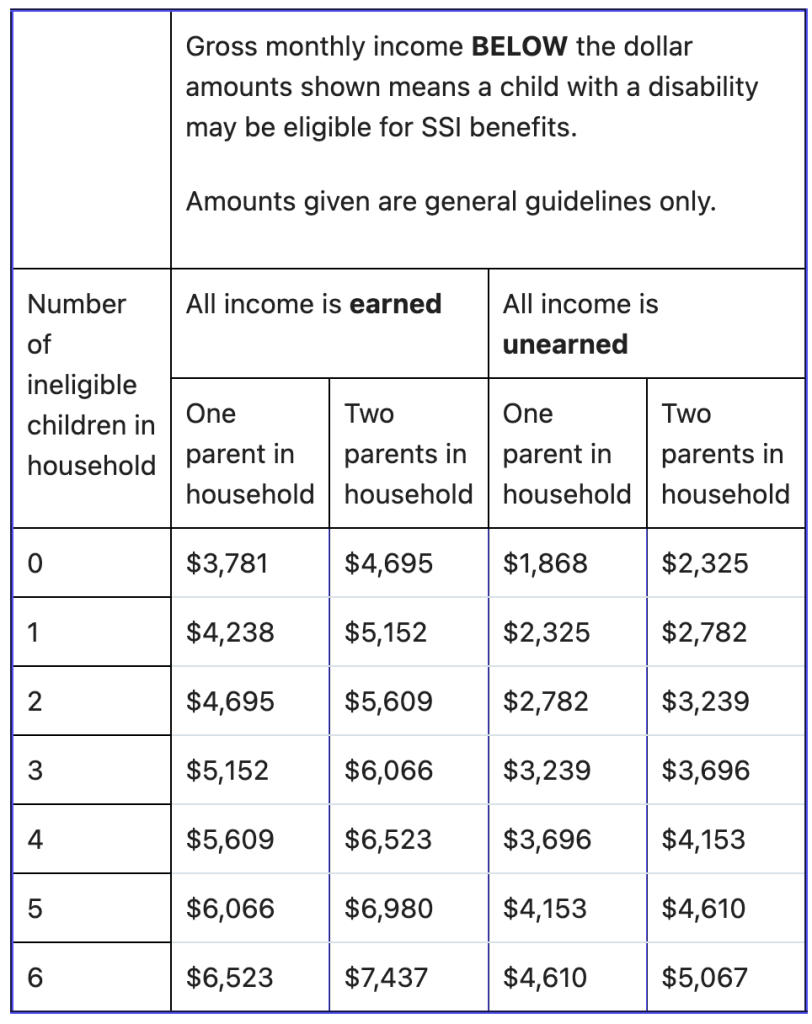

| Low family (income table) | less than $5000 (includes bank accounts, life insurance, etc; excluding 1 car & home if you live in it) | Qualify for |

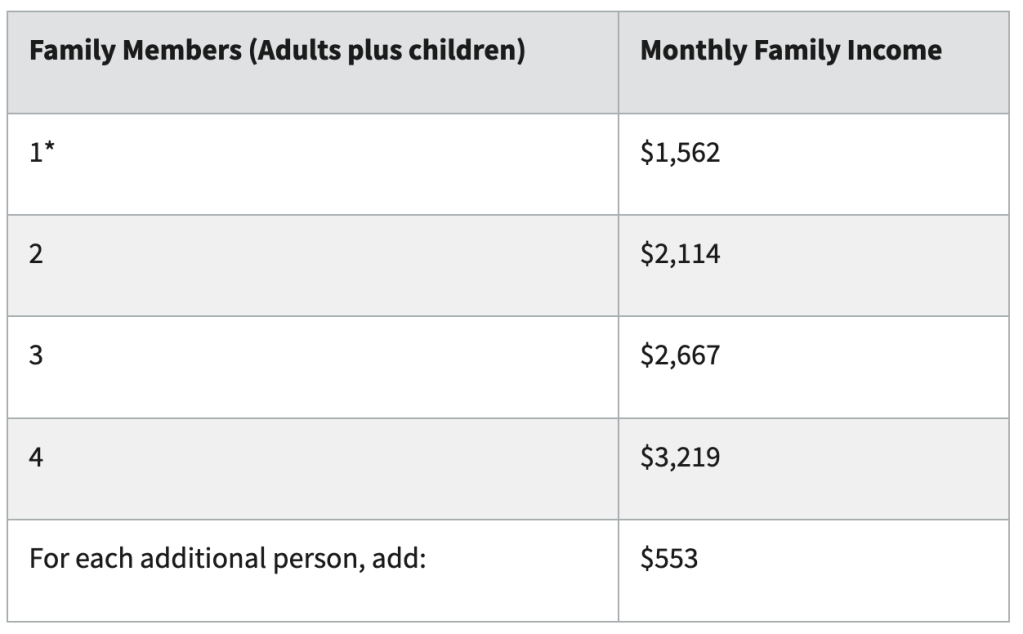

| Middle family (income table) | No limit | Medicaid Buy-In for Children |

| Unlimited family income | No family asset limit | Qualify for a Medicaid Waiver |

Adults (18+ years old)

| Income level | Asset level | Program |

| Low individual (<$1911 earned income) | Individual+spouse assets less than $2000 (includes bank accounts, life insurance, etc; excluding 1 car & home if you live in it) | Qualify for Social Security SSI |

| Middle individual (3x SSI limit, 2023 $2742) | For Medicaid waiver: Individual+spouse asset less than $2000 | Qualify for a Medicaid Waivers |

| Middle individual | $7,570 individual $11,340 couples | Medicare Savings Program |

| High individual (calculations) | less than $5000 (spouse assets excluded, retirement accounts excluded) | Medicaid Buy In for Adults |

INCOME TABLES

Calculating max earned income to continue to receive SSI

| Calculation of Countable Unearned Income | |

| Unearned Income | $0.00 |

| (minus) General Income Exclusion (GIE) | -$20.00 |

| Total Countable Unearned Income | $0.00 |

| Calculation of Countable Earned Income | |

| Earned Income | $1911.00 |

| (minus) Student Earned Income ExclusionIf an employee is less than 22 and in-school, they qualify for the Student Earned Income Exclusion which lets them make $8950/year without reducing their SSI. To request this, provide proof of school enrollment and request the SEIE Exclusion be applied to their SSI account.https://www.ssa.gov/ssi/spotlights/spot-student-earned-income.htm | -$0.00 |

| (minus) GIE (if not used for unearned income) | -$20.00 |

| (minus) Earned Income Exclusion (EIE) | -$65.00 |

| (minus) Impairment Related Work Expenses (IRWE) https://www.ssa.gov/ssi/spotlights/spot-work-expenses.htm | -$0.00 |

| Subtotal 5 previous lines = Remainder of Earned income after Exclusions | $1826 |

| Divide subtotal by 2 and subtract this portion from the previous line | -$913 |

| Total Countable Income | $813.00 |

| Calculation of Monthly SSI payment | |

| SSI Rate ($914 2023 Federal Benefits Rate) | $914.00 |

| (minus) Total Countable Income | -$913.00 |

| Adjusted SSI payment | $1.00 |